How Moderna Helped Launch a Vaccine Revolution

0 View

Share this Video

- Publish Date:

- 5 May, 2021

- Category:

- Covid

- Video License

- Standard License

- Imported From:

- Youtube

Tags

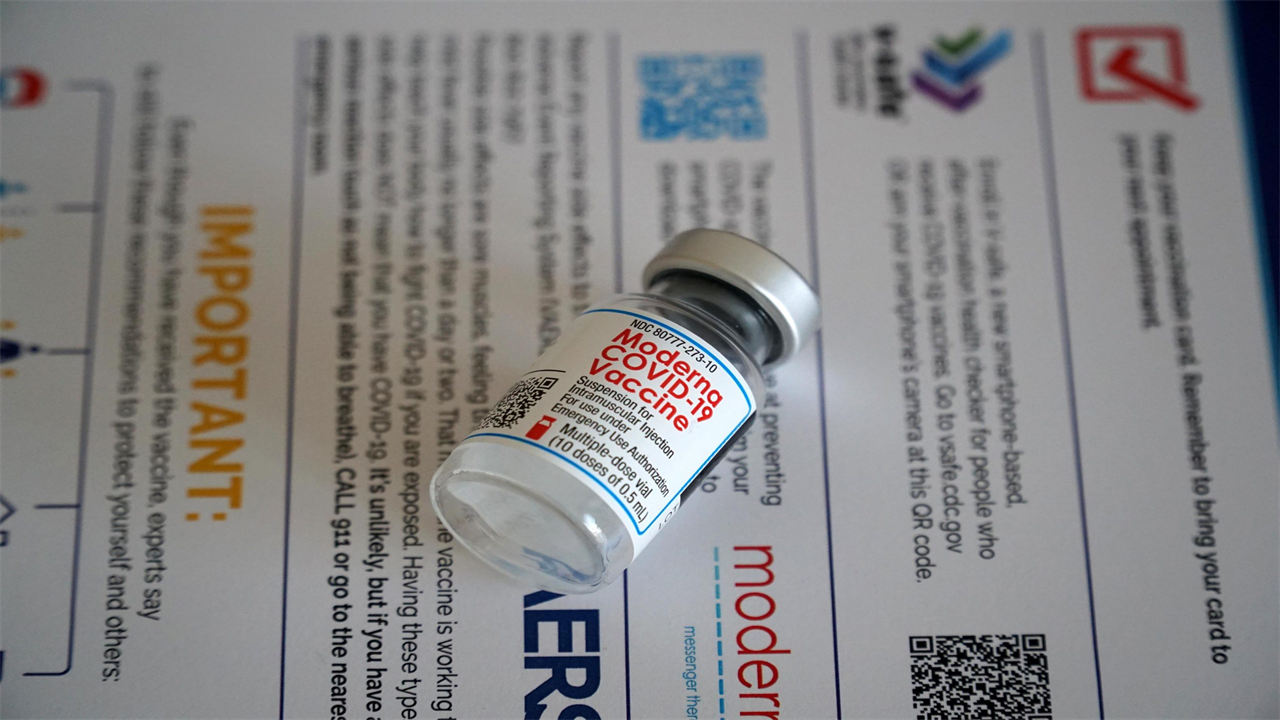

As a start-up biotech company, Moderna did not have an established global network, making US government support critical to the success of the COVID-19 vaccine.

Moderna CFO David Meline, University of Chicago MBA’86, discusses launch of innovative mRNA technology.

With a successful mRNA coronavirus vaccine, 24 products in the pipeline and a tenfold increase in stock price since January 2020, Boston-based Moderna is redefining lightning-fast innovation. The company employs only 1,500 employees and was able to enter public-private partnerships to play a major role in what was nothing short of a vaccine revolution – walking a complex path and rolling out millions of vaccine doses less than a year after the beginning of a global pandemic.

David Meline, alumnus of the University of Chicago, MBA’86, joined the then-development biotech company as CFO in June 2020. Prior to that, he was CFO at biotech Amgen and 3M, as well as 20 years at General Motoren. A constant throughout his career has been an appreciation for ‘data and hard facts’ – something that goes back to his incoming student orientation at the Booth School of Business.

Last month, Meline joined Randall S. Kroszner, deputy dean for executive programs and the Norman R. Bobins professor of economics, for a virtual chat as part of Chicago Booth’s Road to Economic Recovery series. They discussed Moderna’s meteoric rise, why the company felt it was essential to make vaccine doses prior to FDA approval, and what Meline has learned as a senior leader at this historic moment.

Randall S. Kroszner: Prior to the COVID-19 vaccine, Moderna had a promising pipeline of mRNA technology, but the first product was not expected to hit the market for another four or five years. How did you personally decide to make the career leap to Moderna after working at some of the largest and most established companies in the world?

David Meline: When the company contacted me, I had just finished six years as Amgen’s CFO, so I was familiar with the biotech industry. Moderna was planning the Phase 3 clinical trial for its coronavirus vaccine, a trial that would involve 30,000 people and could receive FDA approval. I understood that there would be no more interesting, exciting and effective challenge, so I decided to join. And they understood that I knew how to build international businesses.

Kroszner: What was it like to build an international production network for the production of coronavirus vaccines from the start?

Meline: When I joined Moderna, we started to build a largely external network, working with skilled manufacturers. We signed contracts, we lined up raw materials worth hundreds of millions of dollars, and we had dedicated suppliers. Then we were in talks with governments around the world who – last summer – were eager to sign a contract with us, even though the technology was not yet proven at the time. In the middle of the pandemic, there was a lot of interest in contracting. We recently announced the signed contracts – totaling $ 18.4 billion – that we have entered into deliveries in 2021. We have delivered 67 million doses and are on track to 100 million in the first quarter. So far so good.

Kroszner: The US government took a risk through Operation Warp Speed by supporting companies, including Moderna, to develop COVID-19 vaccines more quickly. What role did this ultimately play in vaccine development?

Meline: The US government has decided to place bets on three different technologies, investing in and contracting two manufacturers for each type of vaccine. In our case, we were a biotech start-up without a history of products. We didn’t have the advantage of a global network, we had no infrastructure, and we had no credit. The support we received in the partnership with the US government was critical to our ability to get to market quickly. We also benefited from the government’s recognition that this mRNA technology, which had never been brought into the world, would likely be a good fit for the challenge.

“… this mRNA technology, which had never been brought into the world, was probably up to the challenge.”

– Moderna CFO David Meline, MBA’86

Kroszner: In retrospect, Moderna took a new approach to risk investing, making the vaccine prior to regulatory approval. What did you learn?

Meline: If you look at the investment thesis, we took investment risks before you traditionally would. When you develop a product like this, you normally go through a series of trials and as you go along, you take incremental investment and scientific risk. In this case, we performed these steps in parallel due to the urgency of the pandemic situation. On the scientific side, it was in close collaboration with the FDA in the US and with health authorities around the world, because you monitor safety and cannot compromise in any way.

At the same time, we invested in listing the commercial offer and started producing products as early as the summer of 2020. Had it not been approved and launched, we would have made a loss on those investments. Fortunately, the product came through with 94% efficacy, which is one of the best for vaccines we’ve seen in history. We were able to successfully launch and ramp up the product because we took the risks of investing.

Kroszner: Some of my Booth colleagues published a newspaper on accelerating the availability of vaccines through market forces for a social purpose and have been involved in COVAX, the global initiative to bring vaccines to the more vulnerable populations in emerging markets. What is your opinion about it?

Meline: The questions of access, fairness and equitable distribution are important. We have continued to engage in a dialogue with COVAX about the offering and we are interested in that mechanism. As a start-up company, we have no existing commercial infrastructure, not even in the United States, Western Europe or Japan, let alone in the developing markets around the world. We are interested in how we can potentially give all citizens access to our product and we recognize our responsibility to do so. COVAX is clearly a mechanism that allows us to access parts of the world that would otherwise be inaccessible to us.

Recently, we have seen some of the countries that are COVAX participants come directly to us. For example, in recent weeks we have announced contracts with the Philippines and Colombia. Mutations arise from infected people who have not been vaccinated, so until you have a wide distribution of vaccines, you will continue to see the active evolution of the virus. So there are some strong reasons for widening access from a public health point of view.

Kroszner: Will vaccines be open to private market participants as the pandemic enters its next phase?

Meline: Until now, our customers have been governments and health authorities around the world. We have two supply chains that we have set up: one is US-based manufacturing for distribution within US borders. The other was set up in conjunction with our Swiss manufacturing partner, Lonza, to fulfill our international contracts. As we move past the pandemic phase to a more stable, endemic phase, you will likely see a transition to a private market, at least in some countries. It is reasonable to expect that this process will eventually be similar to what you see with vaccines for other diseases.

Kroszner: Can you talk more about the possibility of a COVID-19 booster, and what else is being done at Moderna?

Meline: We’ve started some additional tests in the past few weeks, and there’s a fair chance you’ll see a booster shot recommendation, perhaps as early as the end of this year. Overall, we believe this mRNA technology will be effective in terms of its adaptability to guide the evolution of this virus, which we believe will continue.

In addition to the coronavirus, we have 24 programs for other diseases in the pipeline, and 13 of them are already in clinical trials. They cover a wide variety of conditions, including a cancer vaccine we are working on and a range of activities around autoimmune diseases. We have made another attempt in the cardiovascular field. And finally, we are also fighting rare diseases that occur in small groups of the population and that we think we can tackle with mRNA technology.

Kroszner: You had to work quickly with diverse teams, including scientists, researchers and data analysts, to get this to market. What was the work environment like and how did you make it work successfully?

Meline: One of the critical aspects is that this was all done through Zoom. By the way, I’ve never met most of my colleagues. We are not the only company dealing with this situation, and it is certainly a real challenge for everyone. Sometimes the urgency of this mission breaks through the barriers that would otherwise hold us back. It is not uncommon for us to conduct a meeting and there will be people on call who will actively contribute to the discussion and problem solving, and at the end of the meeting we will all introduce ourselves as they just joined the company . We tend to seek out people with a high level of experience and expertise in their particular field to help us build the business.

It is clear that the mission we are on and the opportunity to contribute has attracted some of the best and brightest in the world in their fields. My role, of course, is to also understand the tradeoffs between risk and reward financially. I rely heavily on my colleagues to make scientifically comparable decision-making decisions. If you put those together, you can see success.

Kroszner: How has your Booth MBA contributed to your performance?

Meline: Having a preference for data and hard facts is something I learned at Booth and have always been with me ever since. Even during orientation as an incoming student, I learned about the need to build an analytic framework. Once you have performed the analysis, you will be able to understand the alternatives, assumptions and inputs. The strategy is pretty simple once you do that analysis – more often than not, the answers clarify themselves. These days, I always tell my people that I’m sitting at the strategic table because I’m bringing the data – and maybe I have an opinion.